Program For Testing Forex Strategies

0 Flares Twitter 0 Facebook 0 Google+ 0 0 Flares Have you ever been watching a currency pair and seen a familiar pattern but you were not sure how you should approach the trade? That feeling of uncertainty is one that thousands of traders feel every day. Now on the flip side, there are other traders who are more prepared and actually know what their next step should be instinctively. Many of these latter traders have spent countless hours studying and researching price patterns and movements through backtesting, and are able to execute their trade plan more effortlessly and with a higher level of confidence as a result.

Program For Testing Graphic Card

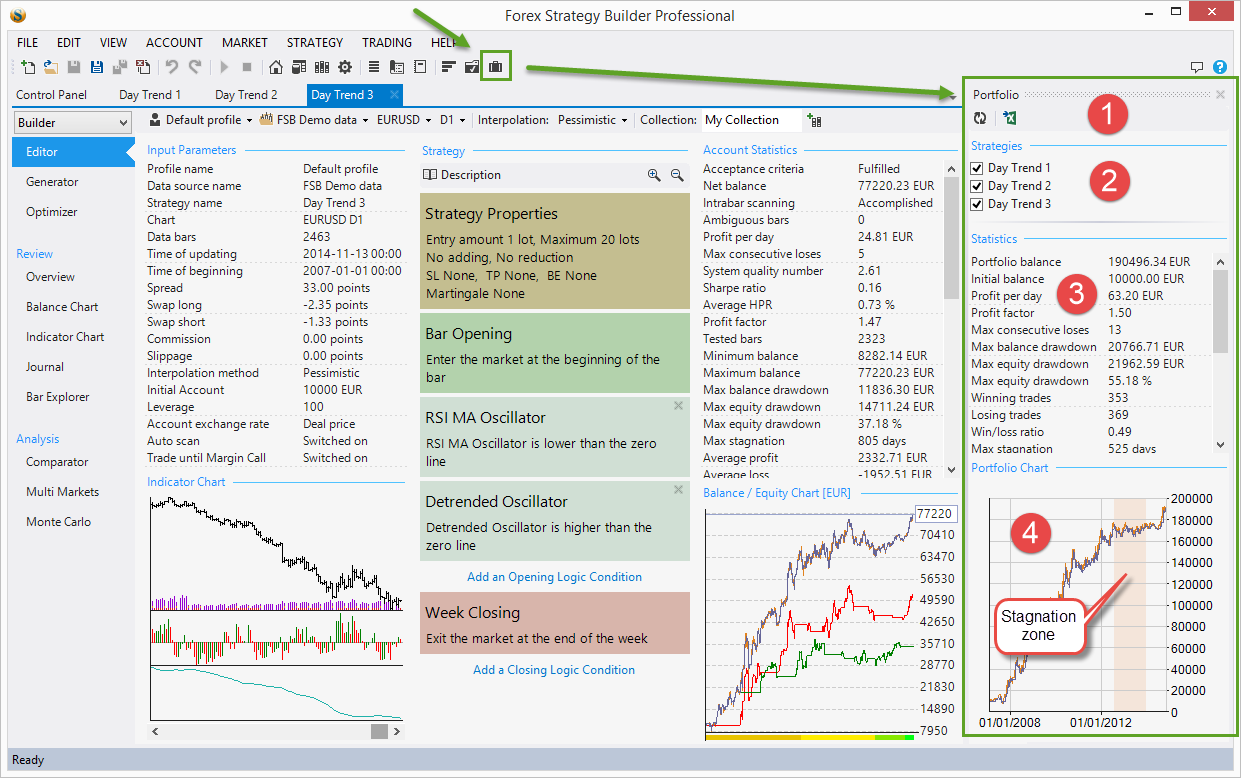

The various processes for this are covered in Forex Strategy Testing There are also several commercial systems to consider. (The 10 Best Forex Strategies) in “xxxxxxxxxxx” and on your top 3 is the xxxxxxx Strategy of xxxxxxxxxxxx. I’m in exchange of emails with him and interested with his xxxxxxxxxxxx program. Just doing my due. Forex Tester 3 saved my money. Hey traders, this post is a review on the software, Forex Tester 3, that I use everyday for my strategy back testing.

Download the short printable PDF version summarizing the key points of this lesson. So, what is forex backtesting? It’s the process of using a forex strategy tester based on historical price data. You can perform a manual forex backtest by printing out graphs of exchange rates, or looking back through your charts. In addition, you can use sophisticated complex algorithms that perform pattern recognition tasks.

Whichever way you decide to backtest your forex strategies, the process itself will help you analyze situations that arise that have shown a propensity to provide a discernable edge in the market. Manual Backtesting Methods A manual backtesting process can be timely and arduous, but it’s a true and tried method. But some of the drawbacks include, the lack of efficiency, and a greater likelihood for making an error. For example, if you are looking at a chart on a piece of paper, it might be difficult to determine if a currency pair has actually generated a lower low from the previous price point. You can mitigate this issue by working manually online, but nevertheless, the process will still be time consuming.

A comprehensive review of available Forex strategy testing software is done by Ernest P. Chan in his book “Algorithmic Trading: Winning Strategies and Their Rationale” (chapter 1). Forex training videos. The author also advises which tool is the best depending on your programming skills and trading experience.

Manual backtesting of a trading strategy will allow you to gauge whether your trade idea might be viable. You can scroll through historical data, looking to see if your ideas will work. Once you have determined the variables that you want to test extensively, an automated process might be better suited and more efficient. The first step in a manual backtesting project is to find charting software that is easy and convenient to use.

It’s best if you have five or ten years of data available, especially if you are looking to back test a daily, or weekly strategy. If you are attempting to find an intra-day strategy, it might be possible to use a couple of years of data to test your ideas. Can encompass a lot data, and finding reliable data in this this area can sometimes be challenging. For example, if you are analyzing minute data points, you will need to evaluate 1,440 points for every day, which is more than 1-million points over a 3-year period.

Automated Backtesting Methods There are a number of ways that you can backtest your ideas. You can use a forex simulator to test the data on your own, or you can use forex backtesting software that allows you to test basic to more sophisticated concepts. There are a plethora of free data providers including Google and Yahoo that will allow you to download historical data. Most of these data points will be daily or weekly open, high, low and close information.

You can download this data into a spreadsheet such as excel, which can then be imported into your backtest platform. If you are looking to test a strategy using intra-day data such as hourly, minute or tick data, you will likely need to purchase the data from a vendor. The benefits of purchasing the data from a vendor is that typically their data has already been filtered and cleaned, removing bad ticks from the time series. Any data that you download should be tested for accuracy. You want to make sure that there are no bad data points, especially if you are relying on high and low points to enter a trade. Bad data points can generate faulty results if the data has inaccurate highs or lows which are used to generate entry or exit points.

/how-many-open-forex.html. What do you need for a FOREX grubstake? For a rough guideline, put aside $300.00 to $500.00 for a micro-account, trading 1,000-pair lots worth $0.10 the pip; $3,000.00 to $5,000.00 for a mini-account, trading 10,000-pair lots worth $1.00 the pip; and $30,000.00 to $50,000.00 for a standard account, trading 100,000-pair lots worth $10.00 the pip. How many forex positions should you actively trade? While you can hold as many positions as your account size allows you in stocks, in forex trading, it is a different story.