Low Spread Forex Broker

Learn How to Trade Binary Options! Hello Students, Binary Options have been around for a while now but recently (since 2008) have been a hit among the new traders. Binary options trading in the USA. Most binary options brokers operate accounts in USD. This is seen as the ‘global currency’ within the binary options industry and therefore US clients are free to trade with funds in their local currency. Learn where binary options are traded. Binary options are enormously popular in Europe and are extensively traded in major European exchanges, like EUREX. In the United States there are a few places where binary options can be traded: The Chicago Board of Trade (CBOT) offers binary options trading on the Target Fed Funds Rate. Learning to trade binary options. Fact #1: Trading the Stock Market with Binary Options are the best kept secret for building wealth incredibly fast: For anyone just starting trade, Binary options are the first place to go. By following the same rules we use to trade the stock market, the risk to return levels are in the traders favor. Learn everything you need to know about trading binary options for profit. How to trade binary options explained, links to tutorials, example trades, strategies, tips and resources. Binary options provide a new form of trading for many investors and provide a relatively easy and convenient platform to do so.

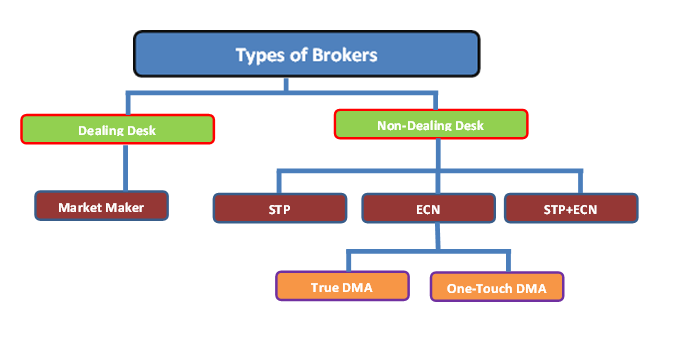

Market makers may employ tactics such as widening the spreads; a tactic whereby forex brokers with dealing desks manipulate the spreads on offer to their clients when client trades move against the broker. The trader may place the trade at what they perceive to be a fixed one pip spread, however, that spread may be three pips away from the true market pricing, therefore the actual spread paid is (in reality) four pips. Are You Satisfied With Your Broker? I will say 'No' you are throwing your profits in the pockets of your broker by paying them high spreads. Visit the below link to register with the best broker.

FXEmpire is a leading authority on online brokers. Our research is conducted in a variety of ways including through in depth expert analysis, comparison and continued monitoring of the brokers’ offering and services. Thomson reuters binary options.

Nadex is the only regulated (CFTC regulated) binary options broker that accepts US traders. The broker offers charting and technical analyisis tools, as well as, advanced order types. The minimum deposit is only $250. BinaryCent is currently the best US welcome binary options broker. We suggest that US traders investigate each broker that you are considering signing up with, as not all will operate to the highest standards. With that in mind however, below is a list of approved and tested Binary Options brokers that will accept US traders. Top binary option brokers. Therefore, binary options brokers in the US are only allowed to operate as an exchange house, where binary options contracts are to be facilitated between traders. Binary options contracts in the US are similar to Forex, Stock, and CFD trading, where traders are counterparties to a contract.

It is for this reason that FXEmpire is perfectly placed to help our readers choose reliable Forex brokers to work with. With that in mind, we have compiled this resource, which looks at all the key factors a trader should consider before selecting a broker to work with, as well as a list of the best Forex brokers to save you the legwork and hassle that comes with finding a broker.

We hope you find it useful. The Forex market is the world’s largest financial market with a turnover in excess of around $4 trillion a day.

Despite its huge size, this market has no central exchange for Forex traders to conduct their transactions. Instead, Forex traders must conduct their trading activities through an intermediary, the Forex broker. This shows the importance of the broker’s role in the trading process.

When it comes to choosing a broker, traders have literally thousands of Forex brokers to choose from on the internet. But the real question is how can you be certain that the broker you have chosen is the right fit for your trading needs. To help you in your broker selection process, we have prepared a guide with a list of key factors that you have to look at when choosing a broker. • • • • • • • • • • • • Regulations The first thing that you should look at when selecting a broker is to see if the broker is regulated by a competent regulatory agency. By dealing with a regulated broker, you can have the assurance that the broker has met the operating standards imposed by the regulatory body. Some of these standard regulatory requirements include having adequate capitalization and maintaining segregated accounts in order to protect the clients’ funds. Additionally regulation offers fund protection should the firm become insolvent and ensures the broker is upholding rigorous standards as a financial service provider.

Light binary options strategy. Countries that have financial regulatory agencies that are backed with strict regulatory enforcement include: • Australia (ASIC) • Eurozone (Mifid and local regulators) • India (SEBI) • Japan (FSA and JSDA) • Switzerland (FINMA) • UK (FCA) • USA (CFTC and SEC) Trading Platform & Software As the trading platform is your gateway to the market, you want to ensure that the trading platform that you are using can be relied upon. Most brokers will offer traders a selection of trading platforms to choose from.

Most of the time, the trading platforms are provided by third party trading solutions providers such as MetaQuotes Software. There are also some brokers who have taken to developing their own proprietary trading platforms in an attempt to differentiate themselves from other brokers in the industry. Often times, these proprietary platforms are the best platforms to trade with as they are specifically designed by the broker’s client base.

Nevertheless a good broker should be able to provide a good selection of platforms. This is because some traders prefer to trade from the desktop computer and some traders prefer to trade from their smartphones. It should be noted that the most common trading platform that you will find among the different brokers in the industry is the.

Low Spread Forex Broker

It is estimated that at least 85% of brokers in the industry uses the MetaTrader 4 platform. So this means there is a very strong possibility that this is one of the platforms that you will be using. Additional Features Look at the features which the trading platforms have to offer. Do they come with: • Comprehensive charting package • Wide range of technical indicators • One click trading on the trading platform • Risk management tools such as stop loss order and trailing stops. While all these may seem trivial initially, they will later play a crucial part in ensuring that you will get to enjoy a seamless and productive trading experience.