Indicators For Trading In Binary Options

How can the answer be improved? Binary options indicators are for all intents and purposes, arithmetic values on charts. The values in question are obtained from formulas centered on price which has four categories here: the Open (opening price), the High Low, and Close (closing price) which can be abbreviated to OHLC.

we trade binary options for you Using Indicators to Help Influence Your Trades Many options traders have difficulties in determining when exactly to pull the trigger and enter into a new trade. Luckily, technical indicator tools are available to help demystify the process and these tools can often be quickly interpreted and placed on your trading platform. To start, we must have an understanding of the and the signals they are sending with respect to price activity in the markets. Once we understand these factors, we can use this information to increase the probability of accurate forecasting for options trades.

Binary Options Trading Signals

First, we will look at each major type of indicator to see how these tools operate. Trend Following Indicators Some traders look to take contrarian approaches to trading but the majority of investors look at the wider trends in the market and then trade in the direction of those trends. To determine the direction of these trends (and then place binary options trades accordingly), we can look at trend following indicators to determine whether we should be looking to buy CALLS or PUTS. One of the most popular indicators in this category is the Moving Average, which marks the average closing price of a set number of time periods. Common settings for this indicator include 10, 21, 55, 100 and 200 time periods.

Traders use these Moving Averages (MAs) in concert with one another to find “crossovers” between a shorter term MA and a longer term MA. You can trade the crossovers at 24option. General Risk Warning: The financial services provided by this website carries a high level of risk and can result in the loss of all your funds. Oil price online forex. You should never invest money that you cannot afford to lose. In a downside crossover, a bearish trend is expected, and this creates an opportunity for PUT options.

In an upside crossover, a bullish trend is expected and this creates an opportunity for CALL options. In the chart below, we can see a downside MA crossover following an uptrend. This would have been an excellent opportunity for PUT options.

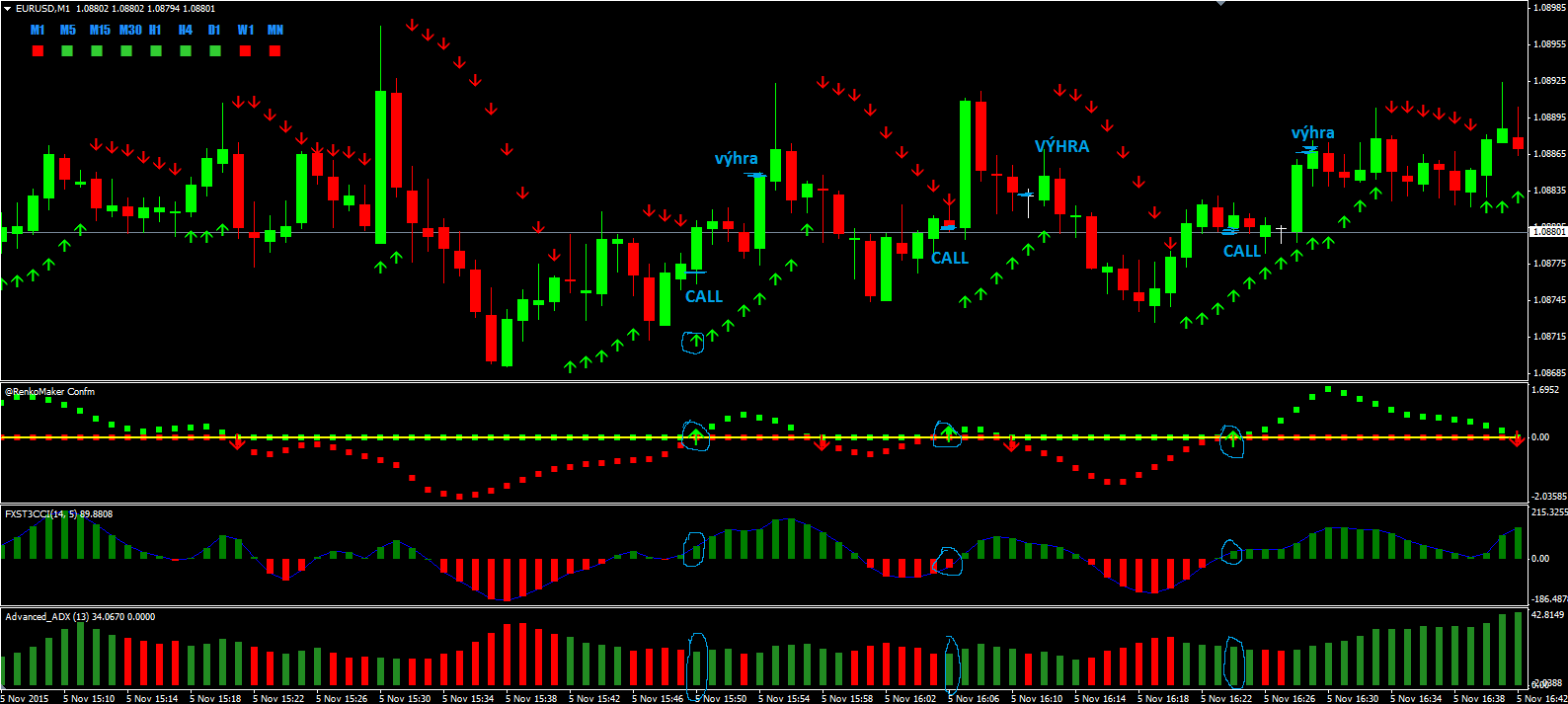

Learn how the Moving Average can help make better decisions Indicators to Confirm Trends While an indicator like a MA combination can give traders an idea of a developing trend, trend confirmation indicators can be used to “confirm” trends that have already been established. These indicators can help to show if trend momentum is healthy and likely to continue (or reverse). One of the in this category is the Moving Average Convergence Divergence (or the MACD), which measures the difference between two moving averages and is plotted against a histogram to help forecast price direction. In the chart below, we can see how buy and sell signals (for CALLS and PUTS) are generated with the MACD. The MACD can help you as a Binary Options Trader The MACD indicator can be used in conjunction with other indicators as well. For example, if we can see a buy signal in the MACD at the same time a bullish MA crossover is seen, an excellent opportunity for CALL options would be developing. Agreeing indicator signals will generally lead to higher probability trading opportunities.

Indicators For Trading In Binary Options History

Overbought and Oversold Indicators Another technical indicator strategy can be seen with the overbought and oversold indicator tools. These tools give traders an indication of when prices have risen too high (become overbought) or become too cheap (and are now oversold). Overbought conditions present opportunities to enter into PUT options (on the expectation of later price declines) while Oversold conditions present opportunities to enter into CALL options (as prices are then expected to rise). One of the most commonly used tools in this category is the (RSI). Basic economics tells us that when asset prices become too expensive, people are less likely to buy that item and more likely to sell it. This situation represents an overbought condition and PUT options become preferable.