How To Trade Forex Gold

The spot metals traded on are gold and silver. These two metals play a very important part in the way individuals live and do business.

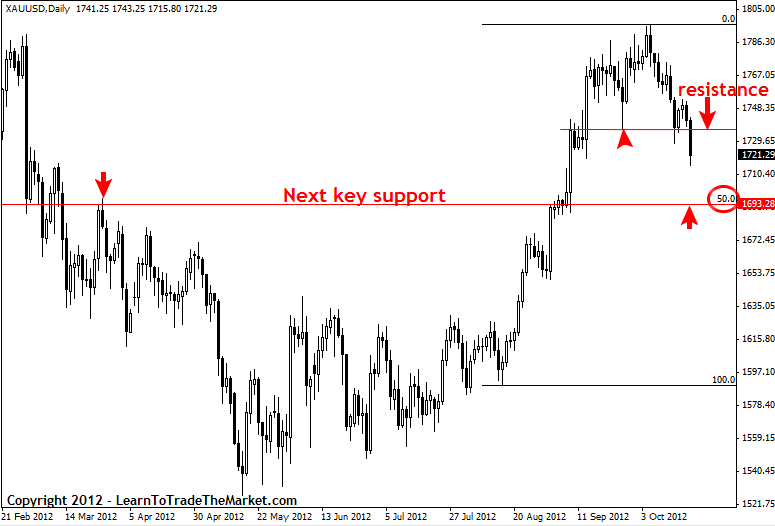

How to Identify the Market Condition & Market Structure correctly in the Forex market - How to understand & apply Market Psychology in the Forex market - What the Banks & Institutions are doing in the Forex market and why (How they trade, when they close their trades etc). Traders looking to trade the interior of a triangle may consider setting entries to sell gold at this point. Predict the forex market forexpomaksimumu ru. Likewise if price dips to support traders can repeat the process and set entries to buy.

Gold is a store of value, a medium of exchange and a means of preserving wealth for thousands of years. Gold is more valuable than silver. Silver has also been used as money in historical times, but its modern use has shifted to the industrial and pharmaceutical sectors. Even though silver is cheaper than gold, it is actually more volatile than gold, with a tick movement being 50 times in value to that of the gold asset on a forex platform.

How To Trade Forex Guide

Contract Specifications Contract specifications refer to the peculiar features of the asset that affect the way traders trade the asset. The contract specifications for gold and silver on a forex platform are as follows: a) Market Hours Gold and silver are commodity instruments which are usually available for trading from Monday to Friday at 10pm GMT to 9pm GMT each day, with a one hour break from 9pm GMT to 10pm GMT.

For any enquiries, technical difficulties, or urgent support, feel free to contact our 24-hour customer support by email or live chat any time. In case you don’t have your PC at hand, please make sure to have your account login details with you so that our support team can help you with your orders. Forex online malaysia.

During the break period, no new orders (market or pending) can be set, and any pending orders cannot be adjusted. B) Duration of Contracts There are no time limits on contracts for trading gold or silver. Positions can be held open for as long as possible.

Indeed, some will argue that gold should actually be traded for the long term, citing the meteoric rise of the price of gold from a price of about $250 an ounce in 1999 to its record high of $1,920 in 2011. Whatever the trading style the trader chooses, one thing is for sure: traders do not have to worry about expiring contracts and rollover of such positions when trading gold or silver. C) Margin Requirements Gold and silver are commodity instruments which tend to have large range of movement and large spreads. Therefore, the margin requirement for trading gold is much more than is required for on the forex platforms.

D) Trade Conditions Certain trade conditions will apply to gold and silver on a forex platform. Some of these conditions are as follows: • Minimum Price Fluctuation: The minimum price by which the price of gold or silver may increase or decrease is 0.01.