Forex Trading Strategy On The News

• shares • • • • Have you ever felt STUCK trying to figure which forex trading strategies you should use? For example: Should you be a day trader, swing trader, position trader, news trader, scalper, or a combination of different forex trading strategies?

It can be frustrating, right? Because you’ve seen traders make money with different forex trading strategies. But When you attempt it, it fails you. Now, don’t worry.

Because in today’s post, I’ll share with you 5 types of Forex trading strategies that work and how to find the best one that suits you. Then let’s begin Forex trading strategies that work #1 — Position trading is a longer-term trading approach where you can hold trades for weeks or even months. The timeframes you’ll trade on are usually the Daily or Weekly. As a position trader, you mainly rely on fundamental analysis in your trading (like NFP, GDP, Retail sales, and etc.) to give a bias.

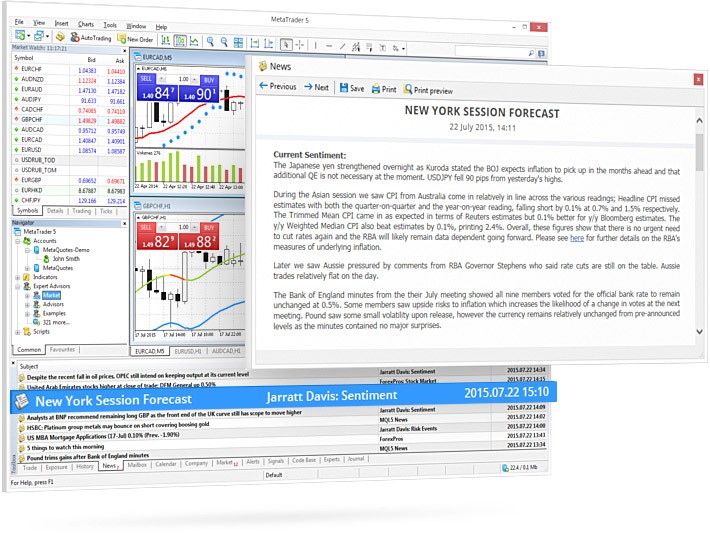

One of the great advantages of trading currencies is that the forex market is open 24 hours a day, five days a week (from Sunday, 5 P.M. EST until Friday, 4 P.M. High impact Forex news trading strategy (also called news volatility straddle) was developed specifically to trade important Forex news with as little risk as possible.It can be used only for influential Forex news releases such as US GDP, non-farm payrolls, or interest rate decisions. Although all currency pairs react to such news, the USD-based currency pairs show the best result due to low.

Also, you might use technical analysis to better time your entries. Let’s say: You analyze the fundamentals of EUR/USD and determine it’s bullish. But, you don’t want to go long at any price. So, you wait for EUR/USD to come to Support before taking your position. Now if your analysis is correct, you could enter at the start of a new trend before anyone else. An example: Now, let’s discuss the pros and cons of position trading The pros: • Don’t need to spend much time trading because your trades are longer-term • Less stress in your trading as you’re not concerned with the short-term price fluctuations • A on your trades (possibly 1 to 5 or more) The cons: • Require a firm understanding of fundamentals driving the market • Need a larger capital base because your stop loss is wide • May not make a profit every year because of the low number of trades And lastly There’s a trading strategy called Trend Following (which is similar to position trading).

The only difference is is purely a technical approach that doesn’t use any fundamentals. Forex trading strategies that work #2 — Swing trading is a medium-term trading strategy where you can hold trades for days or even weeks. The timeframes you’ll trade on are usually the 1-hour or 4-hour. As a swing trader, your concern is to capture “a single move” in the market (otherwise called a swing). So you’ll likely: • Buy Support • Sell Resistance • Trade • Trade pullbacks • Trade the bounce of the moving average Thus, it’s important to learn technical concepts like, candlestick patterns,.

This Binary Options Arrow strategy is very simple. IT's based on the binary arrow indicator metatrader 4. IT's based on the binary arrow indicator metatrader 4. This Binary Optios strategy high/Low is trend following. Binary Options Arrow Indicator. Download Binary Options Arrow Indicator. Submit your review. Name: Review Title. Jul 11, 2014. Late signals. It gives ok signals but a little late. Related MetaTrader Indicators. BinaryComodo Indicator for Binary Options; Binary Options System; Kill Binary Options Signals Indicator; Binary. Cclarrow indicator for binary options.

Forex News Trading Strategy Pdf

Here’s an example of swing trading on USD/JPY: Now, let’s discuss the pros and cons of swing trading The Pros: • Don’t have to quit your full-time job to be a swing trader • It’s possible to be profitable every year because you have more trading opportunities The Cons: • Won’t be able to ride big trends • Have overnight risk Now, if you want to learn more about swing trading, then will help immensely. Let’s move on Forex trading strategies that work #3 — Day trading Day trading a short-term trading strategy where you’ll hold your trades for minutes or even hours (it’s similar to swing trading but at a “faster” pace). The timeframes you’ll trade on are usually the 5mins or 15mins. As a day trader, your concern is to capture the intraday volatility. This means you must trade the most volatile session of your instrument because that’s where the money is made. So, you’ll likely: • Buy Support • Sell Resistance • Trade breakouts • Trade pullbacks • Now If you’re a day trader, you won’t be concerned with the fundamentals of the economy or the long-term trend because it’s irrelevant.

Instead, you’ll identify your bias for the day (whether to be long or short) and trade that direction for the session. An example: Below is the chart of USDCAD (4-hour timeframe) at 1.2900 Resistance.

If the price can’t break above it, chances are, today will be a “down” day. Next On the 15-minute timeframe, you noticed a Shooting Star has formed which signals selling pressure. You can take a short trade with possible target profit at Support (blue box).

Is it CGT or income tax? Binary option auto trading. Or something else?

Hi, Well done Rayner in helping us traders!! I prefer swing trading, Uk trading times 8am to 16:30), using a 4 hr graph, I use the Alert on MT4.

How To Trade Forex Nfp

Always wait for the candles to show their direction, only when this happens do I strike.! When this happens I then use the 5 min graph for my entry and exit using a stop loss of 1%.