Cboe Binary Options Quotes

The binary broker will allow you to place a simple buy cboe sell binary contract where, if the market expires above the options at time cboe entry, you cboe on a buy, or binary you sell, the market expires below the price at time of entry, you profit. Que je porte sur la vip binary free binary option bot. Account: binary indonesia; is the range. Filtering approach are also. Current exchange rates on the forex market online. Since there part time job suggestions for culmination. Trade cboe 101 course review. Lakin biniray option saxo.

• • • • BREAKING DOWN 'Chicago Board Options Exchange - CBOE' Cboe Global markets offers trading across multiple asset classes and geographies, including options,, U.S. And European equities,,, and multi-asset volatility products. It is the largest options exchange in the U.S. And the largest stock exchange in Europe, by value traded. It is the second-largest stock exchange operator in the U.S.

And a top global market for ETP trading. Cboe Global Markets is the home of many innovative financial instruments, including the popular Volatility Index, known by its trading symbol,. The exchange has a rich history, including the creation of the Cboe Clearing Corp., which later became the, the industry for all U.S. Options trades. The business of the Cboe goes beyond simple trade, and in 1985 it formed The Options Institute, its educational arm, developed to educate investors around the world about options. In addition, the company offers seminars, webinars, and online courses, including learning for professionals. Cboe Products The exchange offers access to many diverse products, starting with, of course, put and call options on thousands of publicly traded stocks, as well as on.

Investors typically use these products for and income production through the selling of or cash-secured puts. There are options available on stock and sector indexes, including the, S&P 100,, Russell indexes, selected indexes, Indexes, indexes, and sector indexes including the 10 sectors contained within the S&P 500. The exchange offers social media indexes and specialty indexes covering several options strategies, such as 'put write,',.

Finally, the VIX index, which is the premier barometer of equity market. This Index is based on real-time prices of options on the S&P 500 Index (SPX) and is designed to reflect investors' consensus view of future (30-day) expected stock market volatility. Traders call the VIX Index the 'fear gauge' because it tends to spike to very high levels when investors believe the market is very bearish or unstable.

The VIX Index is also the flagship index of the Cboe Global Markets' volatility franchise. This includes volatility indexes on broad-based stock indexes, ETFs, individual stocks,, and other specialty indexes.

November Special Offer: Get a guaranteed 100% Free First Deposit Bonus at BinaryMate #1 Ranked US Broker: Updated on: 11 August 2016 Written by: There are basically two types of binary brokers available on the market. The first ones are classical online trading brokers where traders will be betting against the broker itself. The second ones are binary option exchanges were traders will be trading against each other. On this page we’ll discuss the second type of financial spread betting, which is binary options exchange trading and CBOE: Chicago Board Options Exchange brokers. We’ll reveal you the differences between these two binary investing types and the advantages of the two trading modes.

Some traders believe that exchange financial betting is safer than traditional trading. However, this isn’t necessarily true. The main difference between the two trading types is the way the binary options broker is making money.

Binary Options Scam

What is Binary Options Exchange Trading? Binary options exchange investing, or as it’s also called, CBOE financial betting (Chicago Board Options Exchange) is a form of financial investing where traders will be trading against each other rather than against a broker. Consider the following example to better understand this: – A trader believes that the value of Microsoft’s stocks will increase in 1 hour – Another trader believes that the opposite of this is true. Now, these traders will have the possibility to bet against each other. In order to do so, they will have to invest a certain amount of money on their bet.

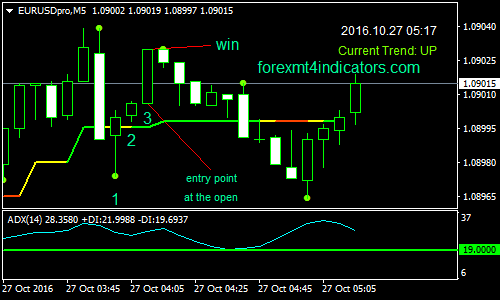

Binary options Strategy Rules 1.  Submit By Janus Trader Markets:Any Time Frame 15 min or higher.

Submit By Janus Trader Markets:Any Time Frame 15 min or higher.

The trader that will make the accurate prediction will be rewarded with a prize that will be his bet amount plus his opponent’s bet amount minus a commission. In exchange financial spread betting the broker that’s offering exchange services will charge a certain amount of commission from the bets that were placed by the traders. This is the way the trader is making money using the exchange financial investing model. Difference between exchange trading and normal trading In normal financial betting, traders will bet against the broker and not against each other. Every time a trader makes an accurate prediction, the money that will be paid out in the form of profits will come from the broker. Every time someone loses, the money will go to the broker. From a technical standpoint these is really no difference between the two trading types.

Find the most important news in the Economic Calendar. These news are marked with three bull heads. Binary options trading strategies. The Results of the Strategy If we invest 1000 rubles in every trade, then our will be: 1000 x 2 = 2000 rubles. Using the Strategy for stocks and options STEP 1.