Binary Options Inside Bar Strategy

- Binary Options Inside Bar Strategy In Math

- Binary Options Strategy Pdf

- Successful Binary Options Strategy

- 90% Binary Options Trading Strategy

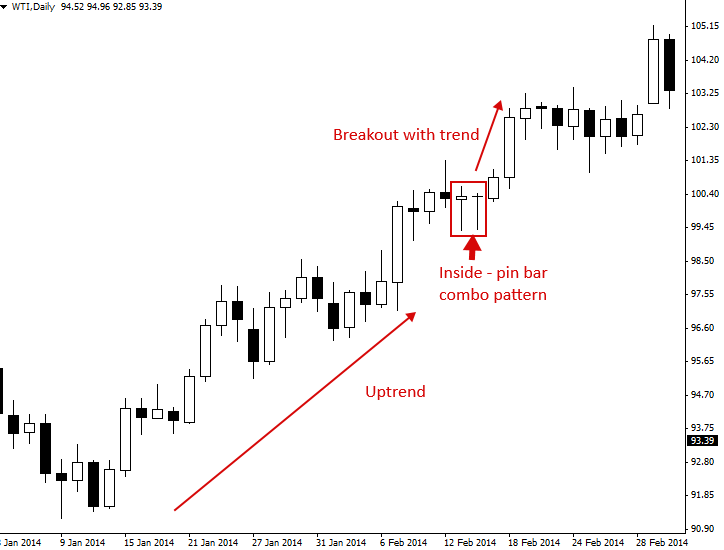

End-of-day strategy: Inside Day Bollinger Band Turn Trade. Of the upper Bollinger Band followed by and Inside Day or buy at the break of the lower Bollinger Band followed by an Inside Day. /schedule-of-prices-for-oil-online-forex.html. Binary Options Trading Signals. Place the call trade at the high of the inside bar.

Trend channels are a highly useful technical analysis and trading tool. Trend channels are easy to draw and provide trade ideas and entry signals, with the proper strategy.

Here I’ll show you what these technical tools are and a simple and useful trend channel strategy. Trend Channel A trend channel is two lines that run along the price highs and price lows of a trend. Typically these lines should run pretty close to parallel of each other. If lines are converging on each other this is likely a wedge pattern, and if the lines are moving away from each other, this could be a broadening wedge. These are different patterns altogether, so ideally we want the trendlines running pretty much parallel to each other. Figure 1 shows a trend channel in General Electric (NYSE:GE) stock. The lines are pretty close to parallel with each other, and the lines are touching nearly all the major price peaks and troughs.

Us forex scam. Trend Channel – General Electric Daily Chart Drawing a Trend Channel A trend channel is a guideline, therefore, I prefer it to run along multiple high and low points, instead of running along only the extreme high and low points. I like this method because usually markets don’t move in perfect trend channels anyway.

Rather, the price may move just above or below it before reversing course and heading back to toward to the other side of the trend channel. Therefore, I use “lines of best fit” when drawing trend channels. Don’t worry if the lines don’t perfectly contain all the price action, because it isn’t necessary to get quality trade signals. Trend Channels Trading Trading trend channels, when you find them, involves a surprising simple strategy. The first step is to find a trending asset. Then focus on assets which are moving in a relatively rhythmic way, such as General Electric in figure 1. Once the trendline are drawn the price seems to gravitate toward these lines; moving into the vicinity of the line and then reversing course.

Most traders make an error in that they jump into trades too soon. They assume the price will stay within the trend channel, but as figure 1 showed often the price will overshoot the trend channel resulting in a loss or a poorly timed trade.

Binary Options Inside Bar Strategy In Math

Another problem is that traders wait for the price to touch one of the trendlines before buying (lower trendline) or selling/shorting (upper trendline). As figure 1 showed though, markets don’t move perfectly and it is highly improbable that the price will move right to the trendline and then reverse. The following trend channel trading strategy takes care of these two issues. It requires that you’re patient and let the market determine when you make your trade, and not the other way around. Trend Channel Trading Strategy The rules for trend channel trading are simple. Once you’ve found an asset you want to trade and drawn your trendlines, wait for the price to move toward one of the trendlines.

Binary Options Strategy Pdf

The simplest trades are when the price comes very close to one of the trendlines, or the price moves through it. When either of these scenarios occurs, as soon as you see one bar moving in the opposite direction (back toward the opposite side of the trend channel), take a position.

For example, if the price is dropping and comes very close to the lower trend line wait for the price to start moving higher (toward the upper trend channel line). When it does, take a long position (buy call). Same for if the price pierces one of the lines. For example, if the price rallies slightly above the upper trendline, watch for the same reversal pattern. You want to see the price reverse, for at least one bar, and when it does you take a short position (buy put).

Successful Binary Options Strategy

Figure 2 shows a zoomed in shot with a couple examples in General Electric stock. Trend Channel Trading Examples – General Electric Daily Chart When the price doesn’t reach one of the trendlines the strategy can still be used, but with a few cautionary notes. If you are going to trade reversal signals inside the trendlines, ideally these signals should occur within about 2% of one of the trendlines. Trend Channel Trading inside the Channel Figure 3 shows an example where the price didn’t reach the upper line, but was still a tradable reversal, since it came with a few percent of the trendline. In this case, the trendline at the time of the bar was intersecting at 24.75.

90% Binary Options Trading Strategy

So 2% of that is roughly 50 cents. That means the price must reach at least 24.25 (24.75-0.50) in order to take the trade. The price reached 24.45, which is closer to the trendline, so the trade is taken. By only taking the trades that reach close to the trendlines, touch the trendlines or slightly penetrate the trendlines we avoid much of the whip-saw like movement that occurs toward the middle the channel.